inherited annuity taxation irs

Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. In this case taxes are owed on the entire difference between what the original owner.

Annuity Beneficiaries Inherited Annuities Death

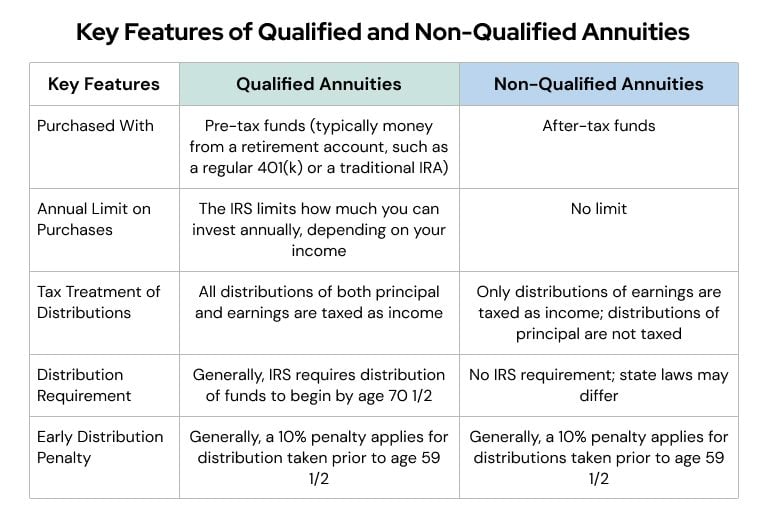

An annuity is qualified if.

. Dear Tax Talk My wife inherited an annuity when her mother died last year. Fisher Investments warns retirees about annuities. Tax-sheltered annuity plans 403b plans.

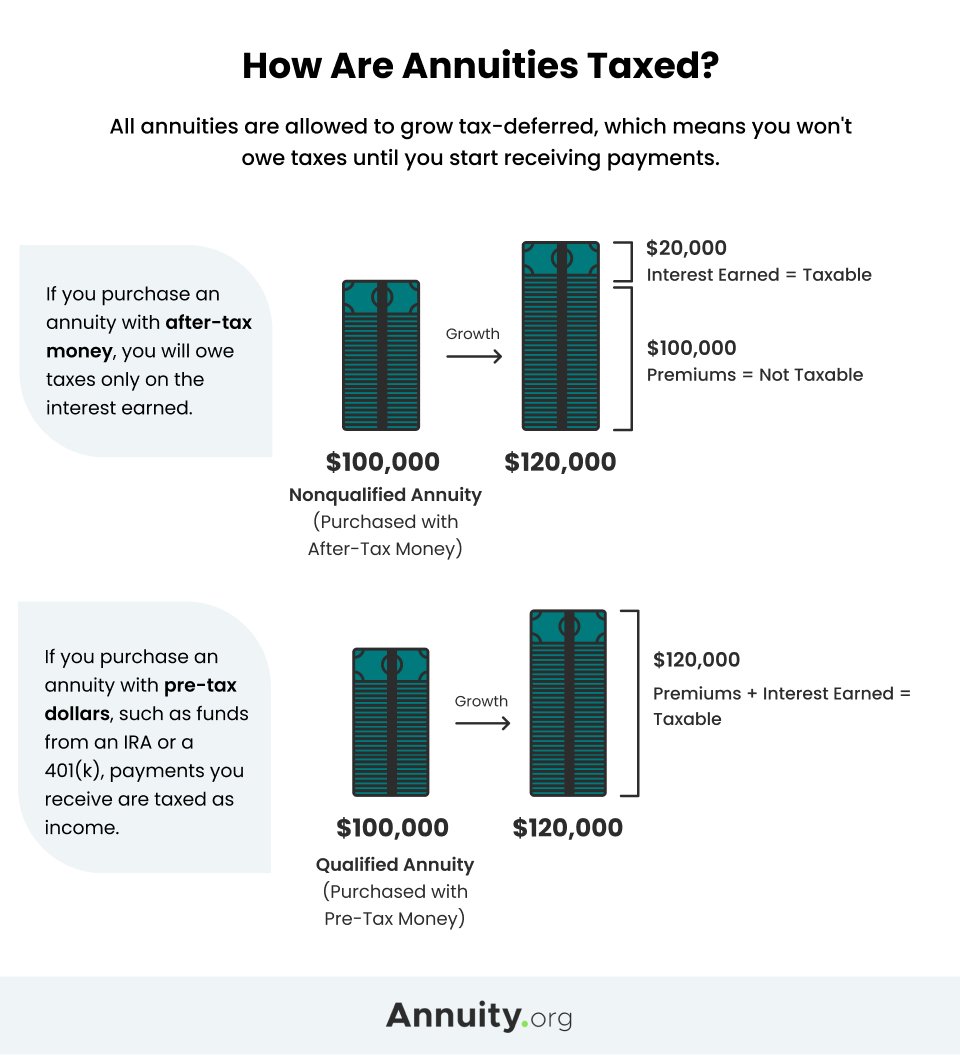

Unfortunately gains are distributed. A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars. You cannot escape taxes if you inherit an annuity.

If you work for a public school or certain tax-exempt organizations you may be eligible to participate in a 403b retirement plan offered by your. To ensure compliance with requirements imposed by the IRS we inform you that any US. The exact amount of the payment that is taxable will vary.

Ad Learn More about How Annuities Work from Fidelity. The reason is that these annuities have already been subject to income tax. These annuities have already been subject to income tax however any.

In turn taxation of annuity distributions. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios. Some portion of the annuity is generally taxable to you.

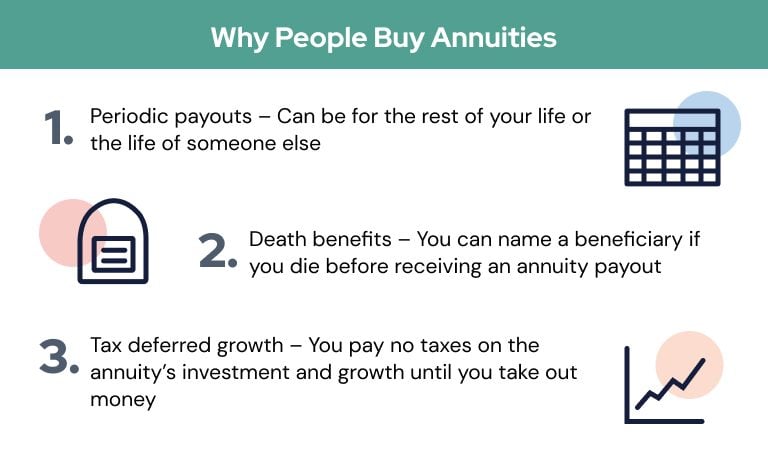

A lump-sum payment is frequently chosen by persons who inherit an annuity. An annuity normally includes both gains and non-taxable principal. However any interest thats been earned will be taxed once withdrawn.

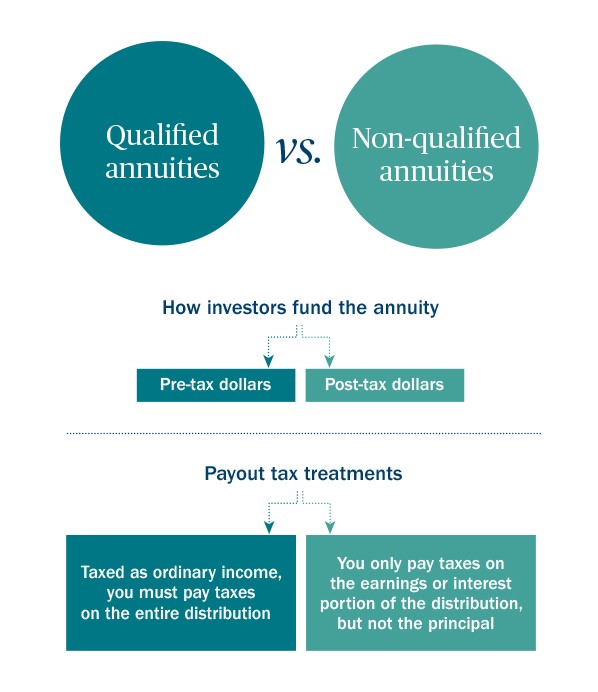

Everything above the initial annuity owners cost is subject to taxation. If you want to understand how an inherited annuity is taxed two terms that are critical to grasp are qualified annuities and non-qualified annuities. If you inherit this type.

The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket. February 26 2020 1008 AM. Tax-deferred annuity beneficiaries can pick from a variety of payment alternatives that will affect how the income benefit is taxed.

This also applies to. As a result inherited annuities are subject to tax. Any beneficiary including spouses can choose to take a one-time lump sum payout.

The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Fortunately though understanding how inherited annuities are taxed can help you avoid paying. But even a series of five equal distributions has tax drawbacks.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Treat it as his or her own IRA by designating. This makes taxing a lot easier.

If a traditional IRA is inherited from a spouse the surviving spouse generally has the following three choices. How taxes are paid on an. Is inherited annuity taxable.

Someone who inherits a non-qualified annuity will have to pay taxes on withdrawals of the earnings but not the principal just like the original owner would. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad Learn More about How Annuities Work from Fidelity.

Inherited from spouse.

Annuity Exclusion Ratio What It Is And How It Works

Tax Deferral How Do Tax Deferred Products Work

Annuity Beneficiaries Inheriting An Annuity After Death

Annuities Explained Information Annuity Basics

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Accident An Unfortunate Incident That Happens Unexpectedly And Unintentionally Explore More Http Www M Annuity Life Insurance Companies Term Life Insurance

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Taxation How Various Annuities Are Taxed

Taxation Of Annuities Ameriprise Financial

Annuity Taxation How Are Annuities Taxed