santa clara county property tax calculator

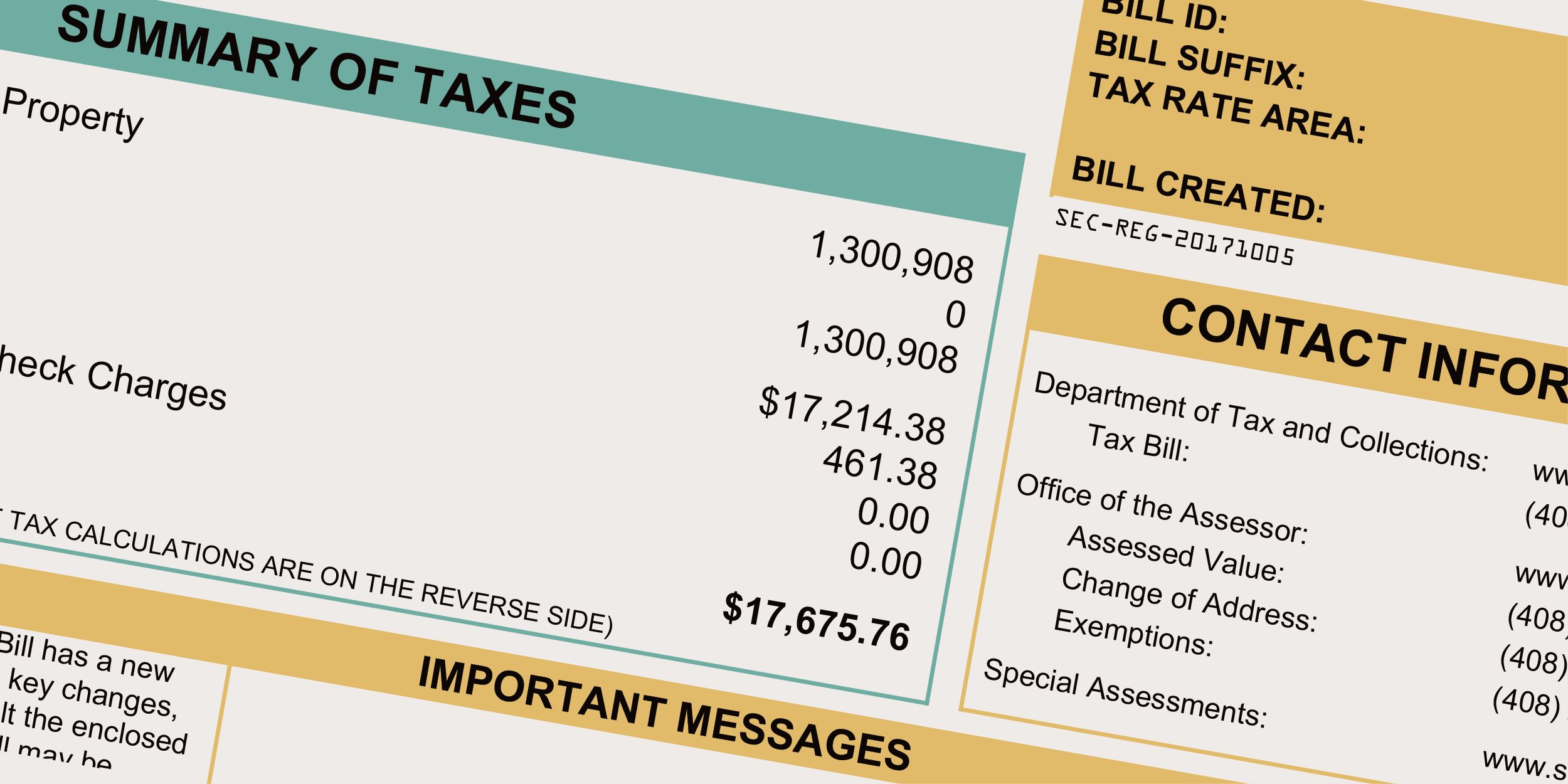

Department of Tax and Collections. The Prop 19 Estimator provides estimates of supplemental assessment s of a hypothetical transfer of ownership of principal residence from one county to another.

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Download all California sales tax rates by zip code. Learn all about Santa Clara County real estate tax.

The Santa Clara County California sales tax is 900 consisting of 600 California state sales tax and 300 Santa Clara County local sales. Learn more about tax credits. Your base Prop 13 assessment will not change.

East Wing 6th Floor. Get your tax credit estimate. Fill out the tax credit calculator.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. The average effective property tax rate in Santa Clara County is 079. The bills will be available online to be viewedpaid on the same day.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. San Jose CA 95110-1767. When mailing a payment include the payment coupon and check.

The Prop 19 Estimator provides estimates of both the supplemental assessment s and the subsequent regular roll assessment due to a hypothetical transfer of ownership of. File for free and get money back. Starting February 16 2021 Proposition 19 narrows substantially the property tax benefits for inherited properties.

Santa Clara County collects on average 067 of a propertys. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Property Tax Rate Property tax is generally calculated as the value of the ADU times the jurisdictions tax rate.

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local. Santa Clara County Property Tax Calculator. The bills will be available online to be viewedpaid on the.

Narrows the Assessed Value that can be. Select your county and enter income and family information. For comparison the median home value in Santa Cruz County is.

Supplemental assessments are designed to identify changes in assessed value either increases or decreases that occur during the fiscal year such as changes in ownership and new. For comparison the median home value in Santa Clara County is. The bills will be available online to be viewedpaid on the same day.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. But because the median home value in Santa Clara County is a whopping 664100 the median property tax amount in the county is 5275. Finally the tax collector prepares property tax bills based on the county controllers calculations distributes the bills and then collects the taxes.

County of Santa Clara.

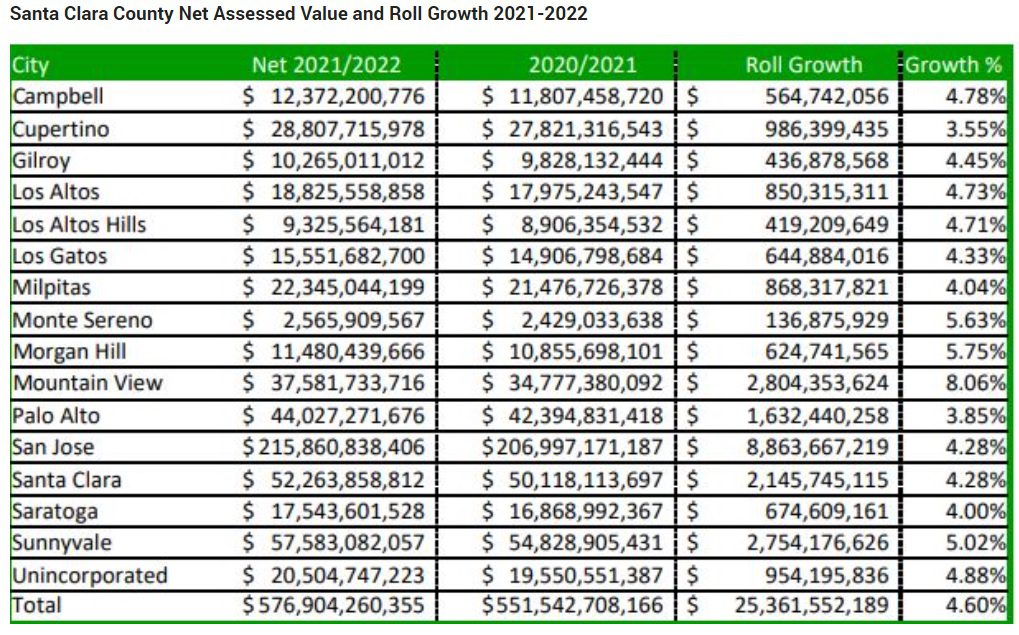

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

How To Calculate Property Tax 10 Steps With Pictures Wikihow

County Of Santa Clara On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future

Property Tax Calculator Estimator For Real Estate And Homes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Secured Property Taxes Treasurer Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Santa Clara County Ca Property Tax Calculator Smartasset

Los Angeles Property Tax Which Cities Pay The Least And The Most

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Transfer Tax Calculator 2022 For All 50 States

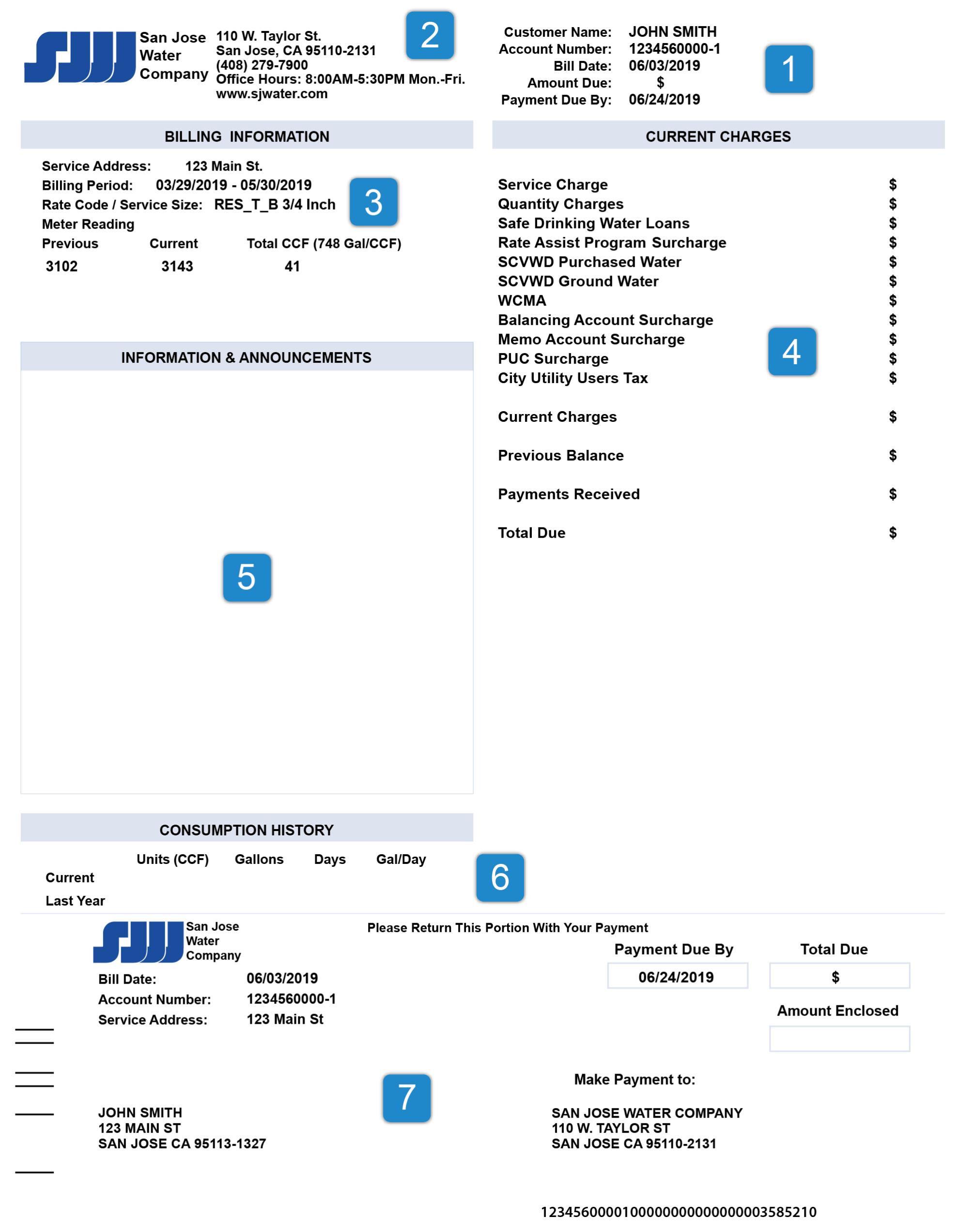

How To Read Your Bill San Jose Water

California Property Tax Calendar Escrow Of The West

Riverside County Ca Property Tax Search And Records Propertyshark